Blog

Is opting out of a workplace pension a false economy?

Rachel is a 35-year-old charity administrator. When she started her current job nearly six years ago, she was automatically enrolled into her workplace pension. Auto-enrolment for workplace pensions was introduced in the UK to encourage more people to save for retirement. It means employers have to enrol into a pension any workers who are: Not […]

Pension Planning for the Self-Employed

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer. Of course, saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, […]

Pension lifetime allowance – how it affects you

In his 2021 Budget, the Chancellor announced a five-year freeze on the lifetime pension allowance. What does this mean for you and your retirement fund? What is the lifetime pension allowance? The lifetime pension allowance sets a limit on how much you can save in your pension before you start paying tax on anything over […]

Five practical reasons you should create a financial plan with your partner

Money and financial goals are still sometimes viewed as taboo subjects, even within relationships. If you’ve been putting off conversations about finances, creating a plan together could have many benefits. Actively talking about money can be positive for both you and your loved ones, and research suggests it’s something younger generations are more likely to […]

Cost of living crisis: Why you should review your budget and plans

The cost of living is rising. Reviewing your finances now is crucial for understanding what effect inflation could have on your lifestyle and long-term plans. Inflation was at an almost 40-year high. In the 12 months to August 2022, it was 9.9%. There are several factors contributing to rising inflation, including the conflict in Ukraine, […]

10 simple ways to cut your carbon footprint and reduce your energy bills

Reducing your energy consumption can be a great way to cut your carbon footprint, lessening your personal impact on the environment and potentially helping to limit the devastating effects of climate change. As living costs and the price of energy are soaring, taking action to lessen your usage can also be an effective tool to […]

Autumn statement 2022: what it means for you

After several months of economic and political uncertainty the new chancellor, Jeremy Hunt, has delivered his autumn statement. With announcements relating to energy bills, Income Tax, the State Pension, tax allowances, and Stamp Duty, there are plenty of ways your finances could be affected in 2023 and beyond. Here are the key points of the […]

What is a Standard Variable Rate Mortgage?

Sarah has never overstretched herself when it comes to money. After paying her monthly bills, she’s always had a bit left over. So, when her mortgage lender wrote to her to remind her that her five-year fixed-rate deal was coming to an end and that she needed to find a new deal or she’d be […]

How might rising interest rates affect your mortgage?

The Bank of England has raised interest rates and warned further hikes are likely in the coming months. This will mean bigger bills for some homeowners. On 3 November 2022, the Bank of England raised interest rates from 2.25% to 3% – the eighth hike since December 2021 – in a bid to combat soaring […]

Downsizing your property to raise money

Your current home may well be the place where some of your happiest memories were created. Realistically, however, downsizing may be an excellent way of financing many more. Here are some points you should consider on the topic. Why should I downsize my home? Home may be where the heart is, but property has a […]

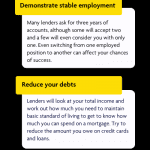

Improving your chances of passing a mortgage affordability assessment

The covid pandemic put things into perspective for Deborah. Before hand-sanitizer and facemasks became the norm, she and her boyfriend were living in a pokey flat while they saved up to buy a place of their own. As the pandemic took hold, they were both furloughed and – for the first time in years – […]

Buy-to-Let Mortgages – What you need to know

Pete has just inherited £35,000 from his grandma and he’s thinking about investing in a buy-to-let property but has no idea where to start. So, what are the key things Pete needs to know? Is the buy-to-let market a good investment? Some of Pete’s friends have warned him that the buy-to-let market is still reeling […]

The Value of Mortgage Advice Part 2

With so many mortgage lenders offering their products on the high street and online, it can be tempting to cut out the middleman and ‘go direct’. When you’re making such a huge financial commitment, the guidance you can get from a qualified mortgage adviser can be invaluable. Here are five reasons we can make a […]

‘The Growth Plan’ – a further update

At 6.00 am on Monday 17 October, the Treasury issued a press release announcing that the (new) Chancellor, Jeremy Hunt, would making a statement “bringing forward measures from the Medium-Term Fiscal Plan”. The timing of the press release suggested that the Treasury was concerned it had not done enough the previous Friday to calm markets […]

Mortgage to Wealth – First Steps Into Investing

Taking Your First Steps Into Investing There is no right time to begin investing but there are some decisions to make that could affect your returns. If you are 7 years old and saving your pocket money for a PS5, 17 saving the money from your first job for a car, 27 saving for your […]

Could remortgaging help you beat the cost-of-living crisis?

Practically every penny of Mike’s monthly salary is accounted for so, as the cost-of-living crisis starts to bite, he’s worried about making ends meet. He’s started shopping around for cheaper deals on his broadband, mobile-phone contract, and car insurance, and he’s also cancelled his gym membership and a couple of his TV subscriptions. But he’s […]

What does the base-rate increase mean for you?

In a bid to tackle rising inflation, the Bank of England has increased the base rate for the seventh time since December 2021. The 0.5% hike takes the interest rate to 2.25% – the highest since November 2008, when the banking system faced collapse. So, what does this mean for you? Mortgages If you’re on […]

Talking to Kids About the Value of Money

After seeing their six-year-old son’s birthday list, Liz and Dan have realised it’s high time they started teaching Archie about the value of money. It’s true they both have reasonably well-paid jobs and only the one child but, even so, a Saint Bernard puppy, a quad bike, a horse and a life-size dalek don’t come […]

Lindsay and Sam have just found out they’re expecting their first baby. Although they’re excited at the prospect of starting a family, it’s come as a bit of a surprise and their current living situation is far from ideal. They’ve been staying with Lindsay’s dad in his two-bedroomed terrace for just over a year while […]

First time buyers guide to saving for a deposit

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation, cost of living and mortgage rates increase, it can mean that some mortgage lenders may require larger deposits of the property value. This can be challenging trying to save a large sum of money and […]

Home Insurance – What you need to know

One wet and windy evening, Rachel and Nathan decided to take advantage of their newborn, Eli, falling asleep in his moses basket by getting an early night. Gently picking up the basket from its regular spot in front of the fireplace, they crept upstairs. No sooner had they settled in bed when they heard a […]

Investing for your children’s future

As parents to four children ranging in age from three to 12 years old, Rachel and Samantha were horrified to hear on the news that a quarter of 20-to-34 year olds still live at home with their parents. As much as they love their kids, the idea they might still be a permanent fixture around […]

Saving for a university education

Funding your child’s university education Sarah and Andrew’s 10-year-old twins, Isabelle and Isaac, couldn’t be more different. While Isabelle is boisterous and full of beans, Isaac is gentle and reserved. The children do have one thing in common though – they’re both extremely bright and they already know exactly what they want to do when […]

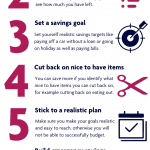

Budgeting tips for saving money while making your life better

Whether you want to go on holiday or just want to save some money for the future, budgeting is a good way to put aside some money for reaching this goal. Here you can find some tips to help you take control of your finances. Why is budgeting so important? You might think that it’s […]

What are value-added services?

Value-added services are benefits included in an insurance policy that you might not be aware of – but could help improve your overall health and wellbeing. When you take out an insurance plan like life insurance, critical illness, or income protection, you get the financial protection in the form of a payout, but there are […]

Holding steady through a sluggish forecast

Markets experienced some June gloom in the wake of further interest rate hikes and lower economic growth forecasts. Global growth is set to slow to 3% this year and 2.8% in 2023, according to the organisation for economic development (OECD). [1] The ongoing war in Ukraine has added to the slowdown, along with high inflation […]

10 ways to reduce your tax bill

Being tax smart means knowing the basics about how tax affects your life and money. Here are 10 ways to reduce your tax bill, which could make your money go further for you and your loved ones. Personal savings allowance You’re entitled to receive some interest on your savings tax-free every year, depending on your […]

What is business protection insurance and how does it work? Find out why it could be right for your business. If you own or run a small business, protecting it is always a priority, especially if something were to happen to a key member, which could affect the financial health of the company. In this […]

A remortgage is the process of moving your home’s existing mortgage to one with a new lender. Remortgaging could help you save money if you weigh up the fees involved with the savings you could make. Here’s how it works. People remortgage for many different reasons, including: Finding a better deal elsewhere – you might […]

We explore how Omnis appoints third-party managers to run funds to provide access the best investment talent in the market. Omnis Investments (Omnis) offers clients of The Openwork Partnership and 2plan Wealth Management a range of 26 funds. They appoint third-party investment managers, allowing investors access to the best talent in the market. No matter […]

Pension Planning For The Self-Employed

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer. Of course, saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, […]

Shareholder/Partnership Protection

If you have a partnership business or one with multiple business shareholders (e.g. a private Ltd Company), have you thought about what might happen if something happened to one of you? This is where a Shareholder or Partnership Assurance Protection plan can help. If a shareholder in your private Ltd company or partner in your […]

Investment Update – A difficult patch for the global economy

Financial markets were unsettled in May as the effects of the war in Ukraine along with concerns over inflation and growth dominated investor sentiment. The International Monetary Fund (IMF) cautioned global finance leaders to expect multiple inflationary shocks in 2022 as markets continued to be unsettled in May amid fears of an economic downturn and […]

Things to avoid when investing

To keep your investments from losing value or slowing the growth of your assets, avoid these common investing mistakes. There are more risks and opportunities than ever for investors to navigate in today’s rapidly evolving markets. Here are four approaches we believe every investor should follow. Don’t pile into cash – stay invested The biggest […]

Make the most of your tax allowances by using the different types of ISAs that are available. Individual Savings Accounts (ISAs) were first introduced in 1999 and are a tax-free way to save into a cash savings or investment account. There lots of different types of ISA available, but the right one for you will […]

Chancellor Rishi Sunak used the Autumn Budget 2021 to invest taxpayer money in long-term plans he says will secure the economic future of the country. Everything from the NHS, schools, local transport and the culture and leisure sector appear set to benefit from the better-than-expected economic outlook from the Office for Budget Responsibility. But immediate […]

Get the best out of your BTL mortgage

Many fixed mortgage deals will be approaching the end of their term this October, so it’s a good idea to review your buy-to-let mortgage. With interest rates still at low levels and demand for rental properties increasing around the country, investing in a buy-to-let (BTL) is a popular choice for many. Buy to let basics […]

Can your pension sustain your retirement?

Working out how long your pension pot will need to last – as life expectancy rises – is worth thinking about sooner than later. The lockdown caused many people to reassess their lifestyles, which for some meant choosing early retirement. But what retirees have found is that pension pots are not matching the period of […]

You might be thinking about whether to invest in crypto currencies. We explain why it may not be the right choice, and how to better approach your portfolio. This year has been eventful for bitcoin, with the cryptocurrency reaching a record high and then almost halving in value all in the space of six weeks. […]

Investments or savings? What’s the best way to safeguard your child’s financial future?

When you see your child dressed up for school for the first time, it’s a stark reminder how quickly time flies. It might feel like only yesterday you were bringing them home from hospital or struggling through their first tooth, but when they walk through the school gates with their backpack and shiny shoes, you […]

Unlocking the value in your home

The number of people using equity release schemes fell last year as older homeowners grew more cautious. Older homeowners seemed to be more reluctant to release cash from their homes in 2020, according to the Equity Release Council. Data from the trade body shows drawdowns from lifetime mortgages fell by 21% last year and 10% […]

Should we be concerned about rising inflation?

Most economists expect inflation to pick up over the next few months as lockdown restrictions ease and shops and restaurants reopen. But is this a cause for concern? As lockdown measures begin to lift, financial markets are making their adjustments in anticipation of a rise in inflation, with bond yields picking up (meaning prices have […]

Protect your possessions with accidental damage cover

Insurance claims for accidental damage increased over the past year as more people worked from home, so it’s a good time to check your own coverage. Figures from some of the country’s biggest insurance providers have shown a sharp rise in claims of accidental damage during the lockdown. With many millions now working from home, […]

We explore what makes an emerging market and why they can offer attractive investment opportunities. For example, South Korea is one of the world’s largest and wealthiest nations. Its GDP per capita – which measures economic output divided by total population – was $31,846 in 2019, outranking countries like Spain, which had a GDP per […]

Turning ‘generation rent’ into ‘generation buy’ – New 95% mortgage scheme to help first-time buyers

Lenders are now offering a government-backed 95% mortgage scheme to help more first-time buyers onto the property ladder. The government is hoping to turn ‘generation rent’ into ‘generation buy’ with the help of a 5% mortgage deposit scheme launched on 19 April. Following the outbreak of the coronavirus pandemic, many lenders withdrew low-deposit mortgages. In […]

How to plan for inheritance tax

Following the news that thousands more people are expected to pay the standard 40% inheritance tax this year because of the effects of the pandemic, we explore some of the ways to navigate the complexities of inheritance tax. The complex laws around inheritance tax (IHT) caught many people off guard during the Covid-19 pandemic. Along […]

Time to consolidate your pensions?

Employer pensions can accumulate as we change jobs, and it’s easy to lose track of how much each one contains. We explore what you need to know if you’re thinking about consolidating your pensions. When you leave a job, it’s easy to forget about the workplace pension you might have had there. With the average […]

Plan for what is difficult while it is easy – Sun Tzu

We all know we need to save for retirement, don’t we? But we also know it’s not always that easy to find the spare cash required to do so, especially amid a global pandemic. Research studies, though, typically show that many retirees wish they’d saved on a more consistent basis and managed to accumulate a […]

Do you know your State Pension age?

Did you know that the State Pension age (SPA) increased to 66 for both men and women in October 2020 and it’s set to rise further? Knowing your SPA, together with how much you can expect to receive, is an important part of your retirement plan that is often overlooked. Why do I have to […]

Are your kids worried about money?

Has the pandemic caused you to worry more than usual about your finances? Well, you’re not alone… With 47% of respondents to a global survey stating they are less well-off now compared to before the pandemic and 24% worried about job security, it’s clear that the virus is continuing to wreak havoc on our financial […]

How to unlock your superhero powers this Father’s Day

Father’s Day is a chance for fathers, dads, daddies, stepdads, and all the honorary dads out there to feel the love, especially after the year we have had. Father figures are often relied upon to protect the family and keep everyone safe from harm, and it isn’t always easy. Even dads are only human, after […]

Could you ‘nudge’ your way to a healthy retirement?

Nudge theory was popularized in 2008 by behavioural economist Richard Thaler and legal scholar Cass Sunstein. In simple terms it is about making it easier for people to make a certain decision that is ultimately in their own self-interest. Day-to-day In the short term there are some financial nudges you can do to apply nudge […]

Step into Spring and refresh your personal financial planning

As we slowly emerge blinking into the sunlight from winter, and, cautiously from lockdown (data permitting), there is a feeling of new beginnings all around. There’s lots of reasons to be hopeful, with light at the end of, for what has been for many, an exceptionally long tunnel. So, with spring burgeoning, harness that positive […]

Don’t underestimate the value of financial advice

Throughout our lives, it is highly likely we will need to take financial decisions that can have a major impact on our wealth, such as taking out the right pension plan, or investing wisely for the future. Over the years, research has produced some interesting findings that highlight the benefit of advice when taking major […]

Are we working from home? Or living at work? With so many of us struggling to find the right balance, we took a look at how you can manage your working life, and set up your home to maximise productivity and relaxation. A few weeks ago, we attended the Mortgage and Protection Roadshow. Typically […]

Be a Superhero! (And make sure that your loved ones are looked after this Mother’s Day)

Nowadays, more than ever, it is important to show our loved ones just how much we appreciate them. On Mother’s Day this year, as we reflect on the last 12 months, you may wish to show your appreciation and demonstrate your love and affection for your Mum, Grandma, Spouse, Sibling, or someone else dear to […]

Preparing emotionally for retirement

You’ve retired from work, you’ve waved a cheerful goodbye to your colleagues and you’re ready for the rest and relaxation you so rightly deserve. It’s exciting! For a couple of weeks. Then the doubt sets in. What will you do with your life, you might find yourself asking? How will you fill the long daytime […]

How do I prove my income for a mortgage?

With Covid-19 rules changing almost daily, extensions to furloughs and local and national lockdowns many are facing money worries this winter. If you’re trying to get a mortgage and want to push your property transaction through before the Stamp Duty holiday ends, how do you prove your income – especially if it has temporarily been […]

How to maximise your allowances to mitigate your tax before 5th April

Even if you’re on countdown waiting for lockdown restrictions to ease, there’s another deadline looming that should not be forgotten. The end of the current financial year on 5th April 2021 is approaching fast. Spend a little time now on an end of tax year action plan with a financial expert and you could save […]

14 reminders this Valentine’s Day to make sure your loved ones remain protected when your circumstances change Love is all around this Valentine’s Day and we’re here to remind you that it’s important to make sure your loved ones are always protected, year round. You’ll typically encounter opportunities and milestones throughout your life which will […]

As a nation, we aren’t great with our financial acronyms and terminology. Life is busy and our heads are often full of important things to get done to make it through the week, without having to worry whether we know our LTV from our ERC! You’re certainly not alone if you’re feeling financially flustered. Recent […]

Do you have ‘cash in the attic’?

Wherever you go, you’d be hard pressed to find a house without at least a little bit of clutter. From the kids’ old teddies (well, they might want Ed the Ted for their own children, you see) to receipts from the 1980s (they might take it back after 40 years), attics and basements across the […]

Exchanging contracts? Get insured first

Purchasing a property can be a busy, stressful time and it can seem like there are a million things to remember. Some things however, are more important to remember than others – for example, getting the right insurance in place at the right time. Many people believe that they only need to take out buildings […]

20 Reasons to Find Your Dream Home in 2020

In 2020 we’ll have been in business for 20 years! To celebrate, each month we’re sharing 20 top tips about topics that are closest to our heart. Our aim is always to provide you with the best possible information so you can make informed financial decisions. This month we’re talking about how our home buying […]

Are you approaching retirement?

If you are nearing retirement, you may have been particularly worried about the impact of recent market volatility on your pension assets and perhaps you are reassessing your retirement plans. There are several things to consider if you are planning to retire, which will depend very much on your own circumstances. Since pensions freedoms were […]

20 Reasons to Renovate Rather Than Move in 2020

In 2020 we’ll have been in business for 20 years! To celebrate, each month we’re sharing 20 top tips about topics that are closest to our heart. Our aim is always to provide you with the best possible information so you can make informed financial decisions. This month we’re talking about why we believe it’s […]

Keep your pension planning on track

The coronavirus outbreak is having a widespread impact across all aspects of our financial life, with many people finding their income reduced. At times like this it can be challenging to stay focused. No matter what age you are, now is not the time to neglect your pension. Try your very best to keep your […]

With policies like home insurance or car insurance, we’re all in the habit of reviewing our cover annually. With a life insurance policy potentially lasting for 20 or 30 years, it goes without saying that over that time, your lifestyle and therefore your cover requirements can change, sometimes substantially. Whenever you mark life’s important milestones, […]

Pension planning for the self-employed

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer. Saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, who might […]

Spotlight on Enterprise Investment Schemes and Venture Capital Trusts

Complex tax-efficient investments such as Enterprise Investment Schemes (EIS) and Venture Capital Trusts (VCT) are a consideration for those who may be able to tolerate a high level of investment risk. EIS and VCT are investment vehicles which encourage investment in small, unquoted trading companies in their early stages, who are typically trying to raise […]

Home improvements to add value to your home

Evidence suggests that many more of us are putting down roots and choosing to stay in our current homes for longer. The average time a homeowner in the UK stays in their property is 21 years. This contrasts with the 1980’s, when a fast-rising property market encouraged a move every eight years on average. However, […]

20 Things You Need To Know About Business Protection

20 Things You Need To Know About Business Protection No-one wants to think about dying or becoming seriously ill. But the truth is, if you own or co-own a business and either you or one of your co-owners were to become seriously ill or die, it could lead to serious problems for the revenue and […]

What are millennials investing in?

It’s seems like every day you see another article in a newspaper about millennials ‘killing industries’ in recent times young people were said to have caused the demise of doorbells, napkins and even breakfast cereal. These tales of millennials bring the end to industries often go viral on social media and bring some interesting responses. […]

“In this world nothing can be said to be certain, except death and taxes.” Financial planning is all about preparing for those things that may not be so certain (and taxes). Plans should be reviewed regularly so they adapt to changes in your circumstances and reflect developments in the wider economy and financial markets. Cashflow […]

What you need to know about self-build mortgages

If you’re thinking of building your own home, financing the project may be high on your list of priorities. Self-build mortgages are different from normal mortgages. They release funds at stages during the building work, rather than in one lump sum when you complete a property purchase. Some lenders also extend a loan to help […]

20 Reasons to Reduce Your Carbon Footprint Through Remote Working

When you set your goals for 2020, I’d be willing to bet you didn’t imagine the events of the last few months. For many people who have lost loved ones, or have been ill, or have had their jobs or businesses badly affected by Covid-19, it’s been a devastating time. We offer you our sincere […]

20 Things You Need To Know About Accident Protection

In 2020 we’ll have been in business for 20 years! To celebrate, each month we’re sharing 20 top tips about topics that are closest to our heart. Our aim is always to provide you with the best possible information so you can make informed financial decisions. This month we’re talking about everything you need to […]

The Bank of…Granny and Grandad?

For many younger people struggling to get a foot on the property ladder, the Bank of Mum and Dad is the only option. With rent taking a huge chunk out of their income and the requirement for increasingly onerous deposits, two in five renters do not believe they will ever be in a position to […]

Protect yourself and your family in 2020

While most of us don’t go through life expecting something bad to happen, the truth is that we never know what’s around the corner. Why not make 2020 the year you put plans in place to safeguard yourself, your family and your home, so that you know you’re protected against life’s unexpected events? When to […]

It’s time to think about life insurance

If you have dependents – people who rely on you financially – then you should have life insurance. In fact, if you have dependents and don’t have life insurance, you are exposing them to grave financial risk. And who would want to do that? Life insurance tends not to feature on ‘to do’ lists because […]

20 Reasons Why You Need Protection

In 2020 we’ll have been in business for 20 years! To celebrate, each month we’re sharing 20 top tips about topics that are closest to our heart. Our aim is always to provide you with the best possible information so you can make informed financial decisions. This month we’re talking about insurance and the reasons […]

20 Reasons Why You Should Consider Switching Mortgages RIGHT NOW!

In 2020 we’ll have been in business for 20 years! To celebrate, each month we’re sharing 20 top tips about topics that are closest to our heart. Our aim is always to provide you with the best possible information so you can make informed financial decisions. This month we’re talking about how you can save […]

Coming to terms with market turbulence

As a direct consequence of the COVID-19 outbreak, global stock markets are suffering a period of turbulence. When markets move significantly it can prove very challenging to hear through the noise and focus on the bigger picture. Lessons from history Over recent years many investors have become used to a variety of political, financial and […]

Statistics show many young people are not using their ISA allowance only 17% of ISA savers are under the age of 35, but half of ISA savers are aged 55. So, what are the options for ISA savers? ISA An ISA is an Individual savings account. It allows you to save tax-free in a cash […]

20 Reasons Why You Should Be Using a Financial Adviser

In 2020 we’ll have been in business for 20 years! To celebrate, each month we’re sharing 20 top tips about topics that are closest to our heart. Our aim is always to provide you with the best possible information so you can make informed financial decisions. This month we’re talking about how we can help […]

Newly appointed Chancellor of the Exchequer, Rishi Sunak, delivered his first Budget on 11 March, against a backdrop of uncertainty following the COVID-19 outbreak and subsequent financial losses. It was the first of two Budgets to be delivered in 2020, with the second to follow in the autumn. COVID-19 and the NHSThe Chancellor wasted no […]

‘Mortgage prisoners’ may be able to remortgage

You may have heard the term ‘mortgage prisoners’ but not know exactly what it is. Mortgage prisoners are those who are trapped in their current mortgage deal and are unable to remortgage or move. The Financial Conduct Authority (FCA) has estimated around 150,000 borrowers are stuck as ‘mortgage prisoners’. Some of the main reasons are […]

More hope for first time buyers with the Help to Buy Extension

Since it was launched in 2013, the popular Help to Buy scheme has enabled almost 170,000 households to buy homes; who may not otherwise have been able to. An extension to the successful scheme was announced in the Autumn 2018 budget, now making it available until 2023 for first time buyers only ‘to ensure future […]

How inflation eats into your returns

Understanding inflation and its impact on your portfolio is important because rising prices can reduce the value of the money you get back from your investments. What is inflation? Inflation is a term used to describe a rise in prices. In the UK, it is measured by the Consumer Prices Index including owner-occupiers’ housing costs […]

What does average look like? Information released by the Office for National Statistics shows the average British man, Mr Average, is 38, will live to 85 and earns £31,103. The average British woman, Ms Average, is 40, will live to 88 and earns £25,308. The LV= risk reality calculator gives you a rough idea of […]

What does Brexit mean for you?

Whichever side of the Brexit debate you have been on, Friday 31 January 2020 undoubtedly marks a momentous point in the country’s history. For at the stroke of 11pm, the UK will cease to be a member of the EU: the divorce will finally have been sealed. It’s clearly been a long and rocky road […]

When it comes to building your investment portfolio, you might have been warned about avoiding putting all your eggs in one basket. It’s wise to spread your money across a range of different investments. That way, if the value of one of them falls, it should have a limited effect on the overall performance of […]

What music do you want played at your funeral?

What music do you want played at your funeral? A quick look at the current top 10 funeral songs turns up some predictable results. ‘My Way’ by Frank Sinatra is favourite, followed by ‘Time to Say Goodbye’ in second place. Another more ironic choice is ‘Always Look on the Bright Side of Life’ from Monty […]

Reviewing your pension contributions

As you approach retirement, you probably want to know when you can afford to stop working. Having worked hard throughout your career you deserve to enjoy your retirement without having to worry about your finances. It may be worth reviewing your pension contributions to make sure you are taking advantage of the incentives offered by […]

Your pension savings, your future options

Why you should consider modernising your pension As well as giving you greater freedom over how you access your savings, there are several other benefits when modernising your pension: — Take full control of your pension savings — Choose when and how to draw an income to suit your retirement planning — Keep your options […]

Where is the happiest place to live?

A new survey has revealed the South West is the happiest place to live in the UK, with Wales coming in as the least happy. The survey by Lloyds Bank and YouGov looked at factors such as: home ownership, salary, household size, knowing your neighbours, loneliness, crime rates, local services and unemployment to create a […]

The electorate has spoken – Conservatives win a majority

The Results Are In Following six weeks of intense campaigning, the result is in. The electorate has delivered its verdict. In Britain’s first December general election in nearly 100 years, the Conservative Party has won a very comfortable majority, soaring past the magic 326 seat mark in the early hours of Friday morning. With the […]

Accidental damage protects against life’s little mishaps

Nobody knows what is around the corner. Accidents can and do happen and the most commonly reported household claim in 2018 was for Accidental Damage. It’s therefore wise to check what is included in your insurance policy to help protect the valuable items in your home. Standard contents insurance usually protects you if you have […]

Winter is coming, and with winter comes unexpected weather patterns and more time spent in the home. Both can lead to an increase in accidents, and accidents for you or children can lead to time off work or loss of income. Outside risks It’s not only the obvious factors of slips, trips and falls and […]