Blog

Living in interesting times: how advice can help

We’re living in unpredictable times; from rising living costs and market fluctuations to fast-moving changes in jobs, tech, and even family structures. For many people, the old financial playbook no longer applies. In these moments, advice isn’t about chasing the lowest cost — it’s about making the right choices for you. Ones that reflect your […]

First-time buyer benefits – what schemes are available?

Any first-time buyer trying to save up for a deposit to purchase their first home may feel daunted by how expensive the housing market is. There is no doubt that it is much more difficult to get your foot onto the property ladder than ever before. In 2023, House Buyer Bureau reported that house prices […]

What does an interest rate cut mean for mortgages?

Every six weeks or so, all eyes are on the Bank of England and its Monetary Policy Committee (MPC) – the group that decides whether interest rates will be increased, held or cut. How they choose to act has an impact on how much it costs banks to borrow money and what rates they can […]

What’s the difference between a product transfer and a remortgage?

If you want to stay on top of your mortgage repayments and ensure you’re getting the right deal for your circumstances then remortgaging is one of the most important financial decisions you can make. But is it best to change to a new mortgage product with your current lender via a product transfer or look […]

Consolidating your pensions – is it a good idea?

Jenny is a 47-year-old Account Manager with a long and varied CV. She hasn’t quite had more jobs than hot dinners but, when she thinks about the various pensions she’s acquired over the years, sometimes it feels that way. Jenny has recently been considering consolidating pensions. But is combining her pensions necessarily the best way […]

Stamp Duty relief not extended for buyers – what you need to know before rules change

In Labour’s first Budget since taking office, the Chancellor announced her plans to fix the so-called ‘black hole’ in the UK’s public finances and increase investment in public services, setting out £40 billion worth of tax rises. While changes to stamp duty did form part of her plans, an extension or permanent change to stamp […]

5 essential tips to protect yourself from financial scams

Cybercriminals use a wide range of tactics to con people out of their money. Stay one step ahead with these five crucial tips to avoid financial scams. 1. Stay informed Knowing how to spot a financial scam is your first line of defence. Fraudsters are constantly changing their tactics so regularly educating yourself about common […]

How to recover from a financial scam

Knowing what to do if you’ve been scammed and where to get help is crucial. Here are five key steps to recover from a financial scam. 1. Act quickly Time is crucial when dealing with financial scams. Take immediate action if you think you’ve been scammed to minimise any further damage. If you’ve shared personal […]

The Value of Investment Advice

Seeking advice on how to look after your money may not be as fun as the immediate thrill of spending it, but it could be a rewarding decision in the long run. Investing can be a daunting task, especially if you’re not sure where to start, that’s where advice can be handy. A financial adviser […]

8 types of financial scams to watch out for

Fraudsters use a variety of approaches to convince you to part with your money. Here are 8 financial scams you should be aware of. 1. Impersonation fraud Scammers often pretend to be a familiar organisation like your bank, a utility provider or HMRC. They might inform you of a (fake) threat to your account and […]

As a parent, you want to do everything you can to ensure that your children have a bright and secure future. One way to do this is by investing on their behalf. Not only can they start adulthood with some savings, but getting children involved early with saving also helps them learn important lessons about […]

What does an interest rate cut mean for mortgages?

Every six weeks or so, all eyes are on the Bank of England and its Monetary Policy Committee (MPC) – the group that decides whether interest rates will be increased, held or cut. How they choose to act has an impact on how much it costs banks to borrow money and what rates they can […]

The essentials you need to know about credit checks before borrowing money

The information a lender finds during a credit check is important – it could affect whether you’re able to borrow money, including through a mortgage, and the interest rate you’re offered. Yet, they can also seem perplexing. Indeed, a Royal London survey found that a third of Brits had never looked at their credit report. […]

It’s time for a fresh look at your finances – where should you start in 2025?

The start of a new year presents a great opportunity to set out your goals and aspirations for the coming 12 months. For others, it can also mean new beginnings, new challenges or simply a fresh start. No matter your mindset for 2025, now is a great time to review your financial goals and plans […]

Have a healthy new year with the additional health services included in your protection insurance

As a new year begins you may want a fresh start for you and your families’ health. Did you know that many insurance policies offer access to a range of health and wellbeing services that can help? You also don’t need to make a claim to use them as your protection policies aren’t just there […]

Stamp Duty relief is changing – what first-time buyers need to know

If you’re a first-time buyer, there are two words that you might not be familiar with – stamp duty. When you are thinking about buying your first home you’ll have been saving for a deposit and thinking about how you will pay to kit out your home but there are other costs to account for […]

Movers face upcoming changes to stamp duty relief – what you need to know

If you’re looking to move house, there’s an important date to mark in your calendar – Monday, 31st March 2025. This is the day that the current stamp duty relief will end and thresholds will change in England and Northern Ireland. But what does this mean for your house move? How much stamp duty will […]

New Year’s resolutions over the Christmas period

The festive period seemed to start early this year with Christmas music played in stores from the middle of November. It seems to indicate that people are starting their Christmas preparations well in advance – or certainly that the shops would like them to. As we go into the Christmas break and towards the period […]

Saving for your child’s university education

Saving for your child’s university education requires careful planning and budgeting. By starting early, considering investment opportunities, encouraging your child to save, looking for scholarships and bursaries, and planning, you can make saving for university a manageable goal and give your child the best possible start in life. What is the average cost of university? […]

Brian’s Sri Lanka Challenge Day 6: Uda Walawe to Galle (approx. 89km)

This year my annual charity bike challenge takes me to Sri Lanka. It will be a hard challenge with 457km of riding and numerous climbs over 6 days. I am raising funds for The Openwork Partnership Foundation, who give grants to small local charities supported by the many members of the Openwork family, and Holding on […]

Brian’s Sri Lanka Challenge Day 5: Ella to Uda Walawe (approx. 102km)

This year my annual charity bike challenge takes me to Sri Lanka. It will be a hard challenge with 457km of riding and numerous climbs over 6 days. I am raising funds for The Openwork Partnership Foundation, who give grants to small local charities supported by the many members of the Openwork family, and Holding on […]

Brian’s Sri Lanka Challenge Day 4: Nuwara Eliya to Ella

This year my annual charity bike challenge takes me to Sri Lanka. It will be a hard challenge with 457km of riding and numerous climbs over 6 days. I am raising funds for The Openwork Partnership Foundation, who give grants to small local charities supported by the many members of the Openwork family, and Holding on […]

Brian’s Sri Lanka Challenge Day 3: Kandy to Nuwara Eliya

This year my annual charity bike challenge takes me to Sri Lanka. It will be a hard challenge with 457km of riding and numerous climbs over 6 days. I am raising funds for The Openwork Partnership Foundation, who give grants to small local charities supported by the many members of the Openwork family, and Holding on […]

Brian’s Sri Lanka Challenge Day 2 – Sigiriya to Kandy

This year my annual charity bike challenge takes me to Sri Lanka. It will be a hard challenge with 457km of riding and numerous climbs over 6 days. I am raising funds for The Openwork Partnership Foundation, who give grants to small local charities supported by the many members of the Openwork family, and Holding on […]

Brian’s Sri Lanka Challenge Day 1: Cycle to Polonnaruwa Ruins and Climb Lion Rock

This year my annual charity bike challenge takes me to Sri Lanka. It will be a hard challenge with 457km of riding and numerous climbs over 6 days. I am raising funds for The Openwork Partnership Foundation, who give grants to small local charities supported by the many members of the Openwork family, and Holding on […]

Autumn Budget 2024: Winners and Losers

Chancellor of the Exchequer Rachel Reeves outlined the Government’s financial plans for the next five years. The measures, which will raise up to £40 billion for public finances, aim to “restore economic stability” and put “more pounds in people’s pockets”. On 30 October 2024, Chancellor of the Exchequer Rachel Reeves announced the UK Government’s Autumn […]

Are you self-employed? We can help you navigate the mortgage market.

Do you feel like you have to jump through more hoops when applying for a mortgage just because you’re self-employed? And not sure which way to turn? We’re here to help. We are mortgage advisers and we can help you navigate the self-employed mortgage market and any of the challenges you may face. What is […]

How to recover from a financial scam

Knowing what to do if you’ve been scammed and where to get help is crucial. Here are five key steps to recover from a financial scam. 1. Act quickly Time is crucial when dealing with financial scams. Take immediate action if you think you’ve been scammed to minimise any further damage. If you’ve shared personal […]

Five essential tips to protect yourself from financial scams

Cybercriminals use a wide range of tactics to con people out of their money. Stay one step ahead with these five crucial tips to avoid financial scams. 1. Stay informed Knowing how to spot a financial scam is your first line of defence. Fraudsters are constantly changing their tactics so regularly educating yourself about common […]

Don’t Fit the Mortgage Mould? We can help you.

If you’ve ever felt like you don’t quite fit the conventional mould when it comes to securing a mortgage, you’re not alone. In fact, more and more people are in the same boat, challenging the standard lending rules. If you’re self-employed, had a credit blip or over 50 you may have encountered challenges when applying […]

Four key signs of financial scams and what to do if you spot one

Financial scams are more sophisticated than ever before, but a few telltale signs can give them away. Here are four ways to spot a financial scam and what to do if you think someone’s trying to scam you. We’d like to think we wouldn’t fall for a financial scam, but the truth is we’re all […]

Eight types of financial scams to be aware of

Fraudsters use a variety of approaches to convince you to part with your money. Here are 8 financial scams you should be aware of. 1. Impersonation fraud Scammers often pretend to be a familiar organisation like your bank, a utility provider or HMRC. They might inform you of a (fake) threat to your account and […]

The Value of Investment Advice

Seeking advice on how to look after your money may not be as fun as the immediate thrill of spending it, but it could be a rewarding decision in the long run. Investing can be a daunting task, especially if you’re not sure where to start, that’s where advice can be handy. A financial adviser […]

I’m over 50 and want to apply for a mortgage

Getting a mortgage in your 50s and beyond used to be a challenge, but things have changed! Nowadays, mortgage lenders are more willing to help older applicants buy homes or refinance. So, if you’re thinking about getting a mortgage later in life, here’s what you need to know. Age limits and what lenders look for […]

Retirement planning – Don’t put it off

Retirement can often seem a long way off – but the choices you make before you stop working can have an enormous impact on the kind of life you enjoy when you finally call time on the nine to five. Our trusted and highly-skilled team of advisers are on hand to give you the best […]

Here’s how financial protection can offer security for parents

Here’s how financial protection can offer security for parents Serious illness can place immense stress on our families. The cost of caring for an unwell child, worry over access to essential services, and the emotional toll of serious illness are all things that no parent wants to think about. We can’t predict what the future […]

2024/25 Tax planning is underway

Every year brings new possibilities – and at the start of the 2024/25 tax year, it’s time to maximise your financial options and opportunities. If you’re an investor or saver then there are plenty of tax perks you can take advantage of. But the clock is ticking before the tax year door slams shuts and […]

Worried a “credit blip” will stop you getting a mortgage?

The cost-of-living crisis and inflationary pressures has put pressure on people’s finances and made it harder for people to get on the housing ladder due to affordability constraints and more people having a less than perfect credit history. How important is your credit history for mortgage lenders? Looking into your credit history is one of […]

Prime Minister Rishi Sunak surprised everybody on 22 May – including many in his party – with his announcement of a general election on Thursday 4 July. At the start of 2024, Rishi Sunak said that his “working assumption” was that the general election would be held “in the second half of the year”. His […]

How to improve your chances of passing a mortgage affordability assessment

Getting on the housing ladder can feel like one of the hardest and longest processes in the world and the cost of living crisis is probably not helping. You need to come across as attractive as possible for lenders to consider you but there are many factors that can reduce how much lenders are willing […]

Considerations for first-time buyers

Being a first-time buyer can be daunting. Not only are you about to make one of the biggest financial decisions in your life, but you’ll probably also have family members and friends offering their ideas on the right house, mortgage, lender conveyancer and even removal company for you. We’ve put together some ideas to try […]

The Effect of Psychology on Investors

You should base financial decisions on logic and facts. But psychology can have a much larger effect than you think, and it can lead to you making decisions that aren’t right for you. Read on to find out more about what behavioural finance is and how it could affect you. “Behavioural finance” was first coined […]

Overpaying your mortgage: should you do it?

Hardly a day goes by without the cost of living hitting the headlines. For many homeowners the increasing costs of owning and running a home is having a huge impact on household budgets. Even if you are near the top end of your monthly budget, or are expecting a ‘payment shock’ when you come to […]

Why Diversification is Important

It is impossible to predict exactly how markets will behave in the future. Trying to predict which single asset class will deliver the best performance will often lead to disappointment. Click here to see how different asset classes have performed over the last 10 years. You’ll quickly see that things change a lot from one […]

How critical illness cover and life insurance work to provide financial security

How do critical illness cover and life insurance work to protect your income from the unexpected? With the rise in the cost of living and borrowing, many people are worried about paying the bills if anything happens that leaves them unable to work. Recent surveys have shown that the average UK family doesn’t have enough […]

Consolidating your pensions – is it a good idea?

Jenny is a 47-year-old Account Manager with a long and varied CV. She hasn’t quite had more jobs than hot dinners but, when she thinks about the various pensions she’s acquired over the years, sometimes it feels that way. Jenny has recently been considering consolidating pensions. But is combining her pensions necessarily the best way […]

Do you keep meaning to sort out your will? We can help you.

Life is busy, we get it. But is anything more important than being in control of your future? Recent research* suggests that only 44% of UK adults have made a will, which means that you’re far from alone if you haven’t yet got around to completing what, for some, appears to be a daunting task. […]

What is a Lasting Power of Attorney (LPA) and do I need one?

A Lasting Power of Attorney (LPA) is a legal document that allows you to appoint one or more people to make decisions on your behalf during your lifetime. The people you appoint to manage your affairs are called the attorneys. An LPA is a completely separate legal document to your will although many people put […]

How to Maximise Your Pension Contributions to Secure your Financial Future

Maximising pension contributions is crucial for securing your financial future. By leveraging tax benefits and participating in retirement plans, you can increase savings and take advantage of employer matching programs. Catch-up contributions near retirement can significantly boost savings. Start early to accumulate wealth and pave the way for a stress-free retirement. Understanding Pension Contributions Pension […]

Our Monthly Newsletter – March 2024

Welcome to the Downton and Ali Investment Insights Newsletter for March 2024. In this edition, we talk about the benefits of starting a pension early, and investment strategies as you approach retirement, and more. Click here to read the newsletter.

Support your family finances: Last minute tax year tips

As we approach the end of the tax year, there’s still time for you to support your family finances, and ensure you use your allowances in an efficient manner. Kick start your child’s financial future Saving for your children’s future is a huge responsibility, although a rewarding one. To give your child a head start […]

Preparing for retirement: the road to financial freedom

Retirement isn’t just about sipping cocktails on a beach; it’s about having the financial security to do so. Fortunately, there are plenty of ways to pave your way to financial freedom when it comes to your time to retire. However, it requires you to put in the work as the amount of money you need, […]

Spring Budget 2024: Winners and Losers

At 12.30pm today, Chancellor of the Exchequer Jeremy Hunt announced the UK Spring Budget, as well as the economic and fiscal forecast by the Office of Budget Responsibility. These legislative announcements are game-changers for Britain’s economy, and Hunt’s announcements included a number of sweeping changes that could potentially affect the personal finances of everyone living […]

As we approach the end of the tax year, it’s a good time to start thinking about how to make the most of the tax reliefs and allowances you’re entitled to, before they are lost. We’ve put together a checklist to ensure you’re aware of all the ways to make sure you don’t miss out. […]

Our Monthly Newsletter – February 2024

Welcome to the Downton and Ali Investment Insights Newsletter for February 2024. In this edition, we’re talking about the latest news in Junior ISAs, busting some investment myths, investment strategies to consider approaching retirement and the effect of psychology on investors. Click here to read the newsletter.

Investing in Stocks and Shares ISAs

Investing in a Stocks and Shares Individual Savings Account (ISA) can be an excellent way of growing your wealth over the long term, providing the potential for higher returns compared to other forms of savings. This post aims to demystify stocks and shares ISAs, explaining how they work, the risks involved, and the potential benefits. […]

Some techniques to think about when you’re investing

Whether investing for the first time or looking to improve your approach, a good place to start is with the people who do this for a living. Here are four techniques the professionals follow that could help you become a successful investor. Think Long Term History shows that patience and commitment tend to reward investors, […]

Key dates for your finances in 2024

As we say goodbye to 2023 and welcome 2024, now’s the perfect time to make sure you’re fully prepared for the financial year ahead. To make it easy, we’ve summarised the key financial dates to put in your diaries: January 1st – New Energy Price Cap – The new energy price cap for the next […]

The essentials you need to know about credit checks before borrowing money

The information a lender finds during a credit check is important – it could affect whether you’re able to borrow money, including through a mortgage, and the interest rate you’re offered. Yet, they can also seem perplexing. Indeed, a Royal London survey found that a third of Brits had never looked at their credit report. […]

Is It Worth Building an Investment Portfolio in an Economic Downturn?

In the face of an economic downturn, many individuals are left questioning the wisdom of investing. The declining market values and financial uncertainties can make the investment landscape seem fraught with danger. However, building an investment portfolio during such times may not be as counterintuitive as it first appears. This article aims to shed light […]

Cancelling your financial protection could be a dangerous way to save money

While the cost of living crisis may be putting a strain on your finances, read why cancelling your financial protection could be a dangerous way to save money Centuries ago, Benjamin Franklin said that… “By failing to prepare you are preparing to fail.” This is especially true when it comes to ensuring your personal finances […]

Five practical ways to protect your money during the cost of living crisis

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021. While the Covid pandemic began the inflationary increase, this was further exacerbated by the war in Ukraine pushing up energy and food prices […]

Understanding Life Insurance: A Guide to Coverage Essentials

When it comes to safeguarding your family’s financial future, life insurance can be a valuable tool. It’s a subject that might seem complex and even intimidating at first glance, but don’t worry, we’re here to make it easier for you. In this guide, we at Downton & Ali aim to break down the basics oflife […]

The 2023 Autumn Statement: Winners and Losers

UK Chancellor Jeremy Hunt’s 2023 Autumn Statement outlined, in his words, “eight months of hard work” and no fewer than 110 measures to help grow the British economy. Contained within are a raft of measures set to overhaul everything from minimum wage and benefit payments to tax, business investment, and more. The Winners Young and […]

What are value-added services?

Value-added services are benefits included in an insurance policy that you might not be aware of – but could help improve your overall health and wellbeing. When you take out an insurance plan like life insurance, critical illness, or income protection, you get the financial protection in the form of a payout, but there are […]

Understanding Critical Illness Cover: A Lifeline for When You Need it Most

Critical illness cover, an insurance policy that provides financial support should you be diagnosed with a specified illness or medical condition, can be a financial lifeline for families during challenging times.The unpredictability of life makes it worth considering, as it provides a sense of certainty in an otherwise uncertain situation. This article will break down […]

The cost of living crisis is causing many to re-evaluate the benefits of financial advice

Traditionally, the value of financial advice has been measured by monetary results of investment performance and returns. Today, the cost of living crisis is causing many to re-evaluate the benefits of financial advice. These days, financial planning is about more than simply looking after your money and protecting your wealth. As well as helping you […]

Income protection – one little change you can make to protect your family’s financial future.

As a parent, providing for your children is a top priority – from making sure they have food on the table, to ensuring they have the extras they need in life. Putting income protection in place means you’ll always be able to support your children with a regular income if the unthinkable should happen and […]

A little change you can make today can safeguard your biggest investment – your home

If you’re a homeowner, your mortgage payments are likely to take up a large part of your income each month. But if you became seriously ill or injured, and unable to work, would you be able to keep up your mortgage repayments? As buying a home is likely to be your biggest investment, it pays […]

Securing Your Future: Understanding Income Protection

In an unpredictable world, it is crucial to safeguard our financial future against unforeseen circumstances. Income protection is instrumental in ensuring you and your family aren’t left in the lurch if you’re unable to work due to illness or injury. Let’s take a look at the basics of income protection and why you might need […]

Protection policies aren’t just there for when things go wrong. Many protection insurers include access to a range of health and wellbeing support services – and you don’t need to claim to be able to use them. These services can make everyday life that little bit easier. From knowing you can have immediate professional support […]

More than a decade of auto-enrolment

Since the government introduced pension auto-enrolment in 2012, millions more workers have started saving for their retirement. Now, the government has confirmed plans to extend auto-enrolment to encourage a savings boost. The changes could have implications for both employees and business owners. Following a review of auto-enrolment the government has revealed key reforms forecast to […]

Being self-employed can be a rewarding and fulfilling career choice, allowing freedom to work to your terms and pursuing passions. However, it also comes with its challenges, one being financial insecurity. Unlike those working within a company, if you’re self-employed you are responsible for your own financial stability. This means taking the necessary steps to […]

How Vitality Health Plans and Employee Benefits Impact Your Company’s Success

In today’s competitive business landscape, offering a comprehensive employee benefits package is crucial to attracting and retaining top talent. One such benefit that has gained significant traction among UK business owners is the Vitality health plan. This unique health insurance option not only provides employees with extensive Vitality health cover but also encourages a healthier […]

The cost of living crisis is causing many to re-evaluate the benefits of financial advice

Traditionally, the value of financial advice has been measured by monetary results of investment performance and returns. Today, the cost of living crisis is causing many to re-evaluate the benefits of financial advice. These days, financial planning is about more than simply looking after your money and protecting your wealth. As well as helping you […]

Safeguarding Your Business: The Importance of Key Person Protection

In today’s competitive business landscape, the success and growth of a company often hinge on the contributions of key individuals. These indispensable team members can make all the difference in driving innovation, generating revenue, and keeping operations running smoothly. But what happens when the unexpected occurs and you suddenly lose one of these crucial assets? […]

3 useful ways to manage your finances and boost your financial wellbeing

The cost of living crisis has dominated the headlines since inflation began to creep up from historic lows in mid-2021. While the Covid pandemic began the inflationary increase, the situation was made worse by the war in Ukraine, which pushed up energy and food prices even further. Following such an extended period of price rises, […]

Being self-employed can be a rewarding and fulfilling career choice, allowing freedom to work to your terms and pursuing passions. However, it also comes with its challenges, one being financial insecurity. Unlike those working within a company, if you’re self-employed you are responsible for your own financial stability. This means taking the necessary steps to […]

Life after your Fixed Rate mortgage. Should you stay with your lender?

Staying with your current lender may feel like the saftest option when your mortgage comes to an end, but that’s no guarantee that you’ll be getting the best deal. That’s why we recommend shopping around to get a mortgage that’s fits you. When there is such uncertainty in the housing market at the moment, you […]

Life after your Fixed Rate mortgage. Should I remortgage when my fixed rate ends?

The short answer? Yes. If you don’t remortgage at the end of your term, you will be automatically transferred to your lender’s standard variable rate, which tends to be higher than the rates on most other mortgage options.* So if you’re coming to the end of your fixed rate mortgage deal, it’s worth shopping around […]

The Pros and Cons of Relying on the Bank of Mum and Dad

It’s no secret that the bank of mum and dad is a popular source of financial help for young people buying their first home. A recent study by Legal & General showed that a whopping 71% of millennials receive support from their parents when buying property. Let’s examine the pros and cons of relying on […]

Life after your Fixed Rate mortgage. What happens when your mortgage deal expires?

If the end of your fixed rate mortgage is on the horizon (even if it’s months away), then it’s a good idea to start looking at your options today. If you haven’t got a new deal in place when your fixed rate mortgage ends, your lender will put you onto their standard variable rate, which […]

Can your energy efficient home help save money on your mortgage?

Have you ever heard of a green mortgage? They’re steadily becoming a popular option for property owners, as many lenders are adding them to their portfolios. If you’re due to remortgage soon and you have an energy efficient home, it’s well worth considering them as a remortgage option. We explore what they are and how […]

First-time buyers guide to saving for a house deposit

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation and the cost of living increases, it can be challenging trying to save a large sum of money. It’s also important to consider all the other costs that are involved in buying a property – […]

What is Shared Ownership and Is It Right for You?

Shared ownership is a government scheme introduced to help people get onto the property ladder. It can be an affordable way for people to buy a home, and potentially a great option for those who cannot afford a property outright. In this blog post, we will look at what shared ownership is, how it works, […]

The Value of Mortgage Advice from a Financial Adviser

Harry and Sam have been staying with Harry’s dad in his two-bedroomed terrace for just over a year while they save up a deposit for their first house. The lack of space and privacy has proved challenging to say the least and would now like to start searching for their own house. Despite having saved […]

With over 10 years of record low interest rates, fixed rate mortgages offer borrowers the stability of knowing what the mortgage payment will be for a set period, which helps with budgeting. Because of the way many lenders decide what rates to offer, we’re currently seeing tracker products priced a lot more competitively than fixed […]

How to improve your chances of passing a mortgage affordability assessment

Getting on the housing ladder can feel like one of the hardest and longest processes in the world and the cost of living crisis is probably not helping. You need to come across as attractive buyers for lenders to consider you, but there are many factors that can reduce how much lenders are willing […]

Don’t Let 2023 Catch You Off Guard – Reevaluate Your Mortgage Rate

If you have a mortgage rate coming up for renewal this year, it is essential to start planning early. Don’t let yourself get blindsided by the rate increases. Having a mortgage review is a key part of ensuring you are in control of your finances when your current mortgage deal is ending. A financial adviser […]

Start of the tax year checklist

The new tax year on 6 April 2023 is a great time to review your finances. The new tax year means annual allowances are reset and ready to be reused – to help you make the most of your money. This year more than ever, with interest rates and inflation on the rise, it’s […]

Why having an emergency fund matters and where to hold extra cash reserves

Having ready cash on hand is an essential part of any successful financial plan. When investing, it’s important to hold an emergency fund. This readily available cash will mean you’re prepared to protect yourself against the unexpected and also plays a vital role in maintaining your financial wellbeing. It’s generally advised to keep between three […]

Make the most of your tax wrappers

It’s a good idea to know how your investments are taxed when selling them. Here are some of the ways you can organise your assets to make them tax efficient. One of the worst things about earning money is that you have to pay tax. Whether it’s your salary or the interest you’ve earned on […]

The start of a new year is a great time to review your finances – whether it’s your savings and investments, mortgages or insurance policies. Higher interest rates and the rapid increase in the cost of living are likely to be affecting many areas of your finances. The start of the year is the perfect […]

Everything You Need to Know About ISA Transfer Rules

ISA transfer rules can be confusing for savers. In this blog post, we will break down these rules and explain how they work. We will also discuss what you need to know before transferring your ISA to another provider. What is an ISA transfer? Moving your savings with an ISA transfer is a great way […]

Inflation explained – why is it so high and how could it affect you?

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021. Following such an extended period of price rises, you may be concerned about your household finances and long-term plans. What is inflation? Inflation […]

Here’s a guide to your annual tax allowances, including ISAs, pension contributions and gifts – and why it’s important to make the most of them. At this time of year, one of the most beneficial things you can do for your money is to review your annual allowances. Make sure you’re using those that are […]

Key Dates For Your Finances 2023/24

Now’s the perfect time to make sure you’re fully prepared for the financial year ahead. To make it easy, we’ve summarised the key financial dates to put in your diaries: March Potential Spring Statement 31st – End of the Help to Buy Scheme – Buyers who applied for the loan have until this date to […]

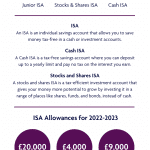

Are you making the most of your ISAs?

You are unable to carry any unused allowances over into the 2023-2024 tax year. If you are unsure on what ISAs are available to you and what they could do for you and your money, here’s how you can make the most of them. ISA An ISA is an individual savings account that allows you […]

In the 2022 Autumn Budget, it was revealed that the Junior ISA (JISA) spending limits would remain at £9,000 for the 2023/2024 tax year. The JISA limit was last changed in early 2020, when it was doubled from £4,500 to its current level. JISA and CTFs both benefit JISAs replaced Child Trust Funds (CTF) in […]

How to Create a Pension Plan for a Secure Retirement

A pension plan is an important part of saving for retirement. It can provide you with a regular income in retirement, which can be used to supplement other forms of retirement income such as private pensions and state pensions. In this blog post, we will discuss the different types of pension plans available and how […]