Home Insurance – What you need to know

One wet and windy evening, Rachel and Nathan decided to take advantage of their newborn, Eli, falling asleep in his moses basket by getting an early night. Gently picking up the basket from its regular spot in front of the fireplace, they crept upstairs. No sooner had they settled in bed when they heard a massive crash from the living room. They ran back downstairs to find a pile of rubble in the exact spot Eli had been sleeping just minutes earlier.

Aware the incident could have been much worse, the couple were still left with an enormous mess to sort out. High winds had caused the inside of the chimney to collapse. However, Rachel and Nathan’s home insurance provider refused to pay for the structural damage because, according to their terms and conditions, the wind hadn’t been strong enough to constitute a storm. They also refused to replace the living room carpet because the couple’s contents insurance didn’t include accidental damage cover.

So, what can you do to make sure your home insurance provides you with the protection you’d expect when the unexpected happens?

Let’s start at the beginning – what exactly is home insurance?

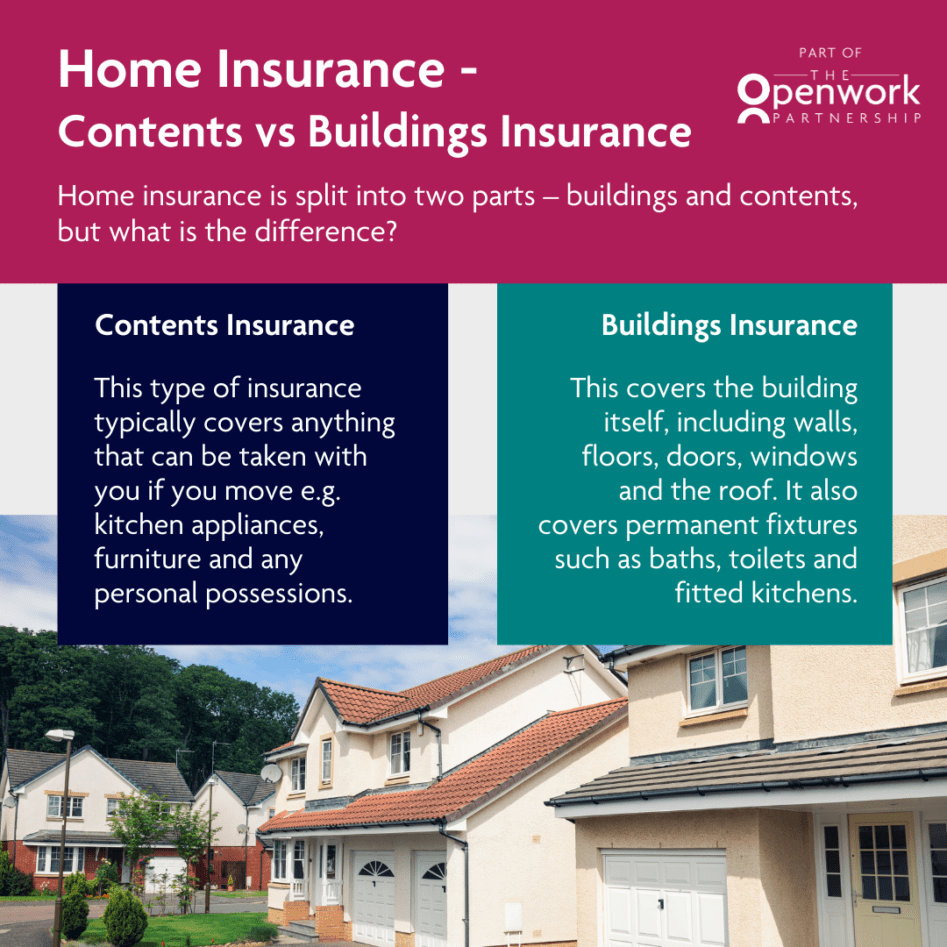

Home insurance is split into two parts – buildings and contents.

Buildings insurance – this covers the building itself, including walls, floors, doors, windows and the roof. It also covers permanent fixtures such as baths, toilets, fitted kitchens and even wallpaper.

Contents insurance – This typically covers anything that can be taken with you if you move e.g. kitchen appliances and furniture.

Not all home insurance is equal

As Rachel and Nathan discovered to their cost, not all home insurance is equal. Although tempting to simply go with the cheapest option, it’s always best to check the details of any policy you’re considering to see exactly what’s included. For example, some buildings insurance covers garages, greenhouses and garden sheds but some policies don’t.

It’s also a good idea to check for exclusions. You may find some insurers won’t pay out for anything considered to be the result of general wear and tear or damage that happens over time, such as damp or rot.

Meanwhile, contents insurance generally has a single-item limit, meaning high-value possessions may need to be named separately. You may also have to pay extra to cover belongings when they are taken outside your home.

Accidental damage cover is something else to think about. Rachel and Nathan decided to do without it. However, if they’d added it to their contents insurance, the cost of replacing their living room carpet may have been covered. According to MoneySuperMarket, mishaps account for over a quarter of all home insurance claims, so accidental damage cover may be worth prioritising.

Reading reviews of insurance providers can also be useful. Most events that result in a claim are pretty stressful, so you don’t need things like poor customer service making matters worse. According to the Association of British Insurers, home insurance prices fell to the lowest levels on record in the first quarter of 2022 meaning you shouldn’t have to pay a fortune for a good policy.

Do you really need home insurance?

Homeowners – although buildings insurance isn’t a legal requirement, most mortgage lenders insist on it. No one is going to force you to buy contents insurance but it can provide valuable peace of mind and combining it with your buildings insurance may save you money.

Renters – you don’t need to worry about buildings insurance – this is your landlord’s responsibility. However, contents insurance may be a sensible idea.